Table of Contents

Tax season always raises questions, especially if you’re an Indian professional working in the USA. Whether you’re on an H-1B visa, recently received your Green Card, or became a U.S. citizen, the 2025 tax rules will impact your paycheck and what you owe to Uncle Sam. Many Indian professionals find it helpful to consult specialized tax experts who understand both U.S. and Indian tax systems. Let’s break down the key 2025 tax rules you need to know and how they affect your filing for 2026.

Why the 2025 Tax Rules Matter When You File in 2026

When you prepare your taxes in 2026, you are reporting income earned in 2025. The 2025 tax rules decide how much of that income is taxed, which deductions apply, and what thresholds you must follow. These rules do not change based on opinions, news articles, or predictions you may read online.

Many people confuse the filing year with the tax year. Filing in 2026 does not mean 2026 rules apply. It means the 2025 tax rules apply, because that is the year the income was earned. The IRS confirms these rules every year through its official guidance, including the publication titled Inflation-Adjusted Tax Items.

For many Indians in USA, this difference becomes clear only after they run into a deadline or IRS notice. Questions about FATCA reporting, FBAR filing, or how foreign income is treated often surface only when someone realises they applied the wrong rule to the wrong year. That experience is less confusing when you understand that the rules being applied to your return are tied to income earned in 2025, not the day you file.

Over years of working as a tax expert, I have seen how this simple mix‑up leads to doubts and unnecessary worry. Once you clearly separate the tax year from the filing year, the 2025 tax rules stop feeling confusing. They become a fixed set of instructions. When that happens, deductions, tax brackets, and reporting steps are much easier to follow.

How Filing in 2026 Uses the 2025 Tax Rules

Once you accept that your tax return filed in 2026 is based on income earned in 2025, the next step is understanding how firmly those rules are set.

The IRS does not change rules after the tax year ends. The 2025 tax rules are locked in once December 31, 2025 passes. Every calculation on your return uses those rules, even if you file early or closer to the deadline.

Filing year and tax year are different

- Filing year is when you submit your return.

- Tax year is when the income was earned.

- When you file in 2026, the IRS applies the 2025 tax rules to your income.

The IRS publishes these rules in advance through official guidance such as Inflation-Adjusted Tax Items. Once published for a tax year, they do not change for that return.

Where confusion usually starts

People often read about possible tax changes late in the year or early in the next one. They assume those changes apply immediately. They do not.

For example, someone who earned a salary and a bonus during 2025 may read about new proposals or future adjustments in early 2026. That information is useful for planning, but it does not affect how their 2025 income is taxed. The 2025 tax rules remain the only reference point for that return.

Why this matters in practice

- You do not need to wait for new announcements to file.

- You do not need to revise a correct return because of future changes.

- Delaying filing rarely improves outcomes when the tax year is already closed.

Pro tip

When reviewing tax information, always ask one question first. Which tax year does this apply to? If the answer is not 2025, it does not belong on a return filed in 2026 for income earned in 2025.

Once this timing is clear, the rest of the return becomes easier to understand. The next step is seeing how your income is reduced before tax rates are applied. That starts with the standard deduction.

The Standard Deduction Under the 2025 Tax Rules

The standard deduction is one of the most significant reductions in taxable income. Under the 2025 tax rules, it directly impacts how much of your salary or income is actually taxed. For most salaried employees, this reduction happens automatically.

What the standard deduction really does

- It reduces your taxable income automatically.

- You do not need receipts to claim it.

- You either take the standard deduction or itemize deductions. You cannot do both.

The IRS explains this clearly in its guidance on Standard Deduction.

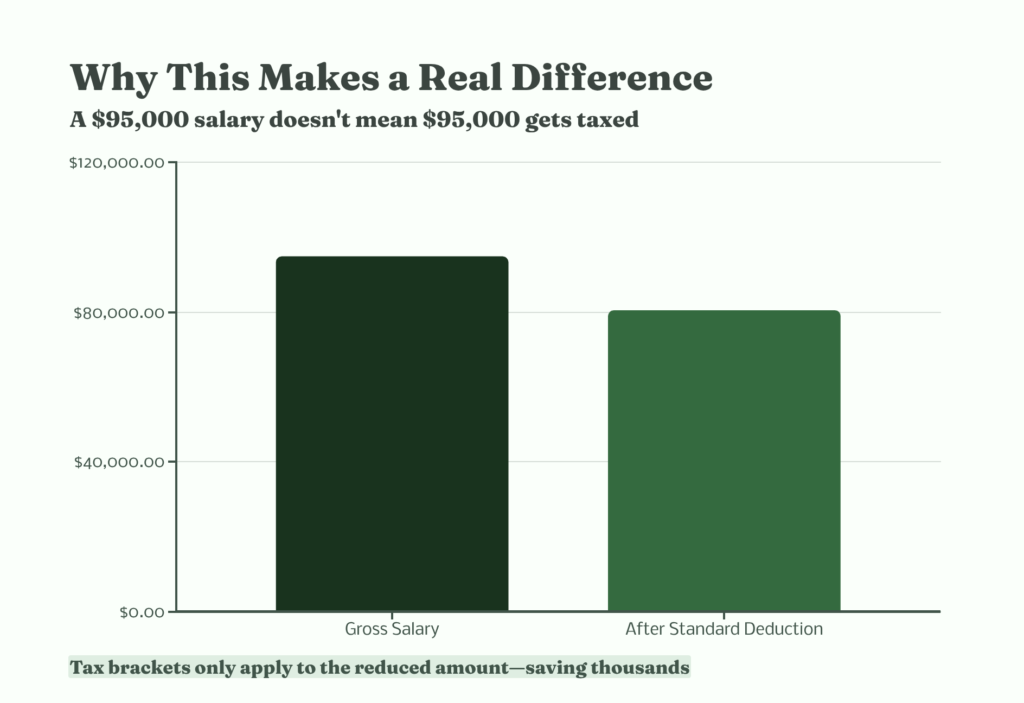

Why it makes a real difference

Many people think tax rates apply to their full salary. That is not how the system works.

Consider this situation:

A software analyst earns $95,000 in 2025 and files as single. Before tax rates are applied, the standard deduction reduces the income that is subject to tax. Only the remaining amount moves into the tax brackets. This one step alone can change the final tax bill by thousands of dollars over the year.

Under the 2025 tax rules, this reduction happens whether or not you actively think about it. But understanding it helps you read your return correctly and avoid second-guessing your numbers.

Where people usually get confused

- They assume itemizing is always better.

- They compare themselves to colleagues without checking details.

- They forget that itemizing only helps when expenses exceed the standard deduction.

If your mortgage interest, state taxes, and charitable contributions do not add up to more than the standard deduction, itemizing can actually increase your taxable income.

Why this matters for Indian professionals

Many people coming from other tax systems expect deductions to depend heavily on investments or spending choices. In the U.S. system, the standard deduction already covers a broad base of everyday expenses. Under the 2025 tax rules, this makes filing simpler for employees with straightforward income.

Pro tip

Treat the standard deduction as your default. Only move away from it after running the numbers both ways. If your financial situation did not change much during 2025, itemizing often does not help.

Once the standard deduction is applied, the next question usually follows. How does the IRS decide which part of your income is taxed at which rate? That leads directly to tax brackets.

How Tax Brackets Work Under the 2025 Tax Rules

After the standard deduction is applied, the next thing people notice is the tax rate. This is where confusion often returns. Many assume that once they reach a higher tax bracket, their entire income is taxed at that higher rate. Under the 2025 tax rules, that is not how the system works.

The U.S. uses a progressive tax system. This means your income is taxed in layers, not all at once.

What tax brackets actually mean

- Your income is split into portions.

- Each portion is taxed at a different rate.

- Only the income within a bracket is taxed at that bracket’s rate.

The IRS outlines this structure in its guidance on Tax Brackets.

A simple way to understand it

Think of tax brackets like steps. You step into the next one only after filling the previous one.

Here is how it plays out in practice.

Suppose a project manager earns $98,000 in 2025 and files as single. After the standard deduction, part of his income falls into the lower tax brackets, and only the last portion of his income is taxed at a higher rate. Under the 2025 tax rules, the higher rate applies only to that last slice of income, not to the entire salary.

This is why two people with similar incomes can have different total tax bills. Small differences in deductions or filing status affect how much income reaches each bracket.

Where people misunderstand brackets

- They focus only on the highest rate they see.

- They assume a raise pushes all income into a higher tax rate.

- They think earning more can sometimes mean taking home less.

That last belief is especially common and almost always incorrect. Under the 2025 tax rules, earning more income does not reduce your take-home pay simply because of brackets.

Pro tip

When evaluating a raise or bonus, look at the marginal rate only for the additional income. The rest of your income continues to be taxed the same way as before.

Once tax brackets are clear, income tax starts to feel predictable. The next area that often surprises employees is investment income, especially when selling stocks or funds.

How Capital Gains Are Taxed Under the 2025 Tax Rules

When you sell stocks, bonds, real estate, or other investments, the money you make from the sale is usually taxed as capital gains. How much you pay in taxes on that gain depends on how long you hold the asset before selling it. Under the 2025 tax rules, long-term capital gains are taxed at a lower rate than short-term gains.

Here’s a breakdown of how it works.

Long-Term vs. Short-Term Capital Gains

- Short-term capital gains: Gains on assets held for one year or less are taxed at ordinary income rates.

- Long-term capital gains: Gains on assets held for more than one year are taxed at a lower rate.

The IRS provides special capital gains rates for long-term gains, depending on your taxable income.

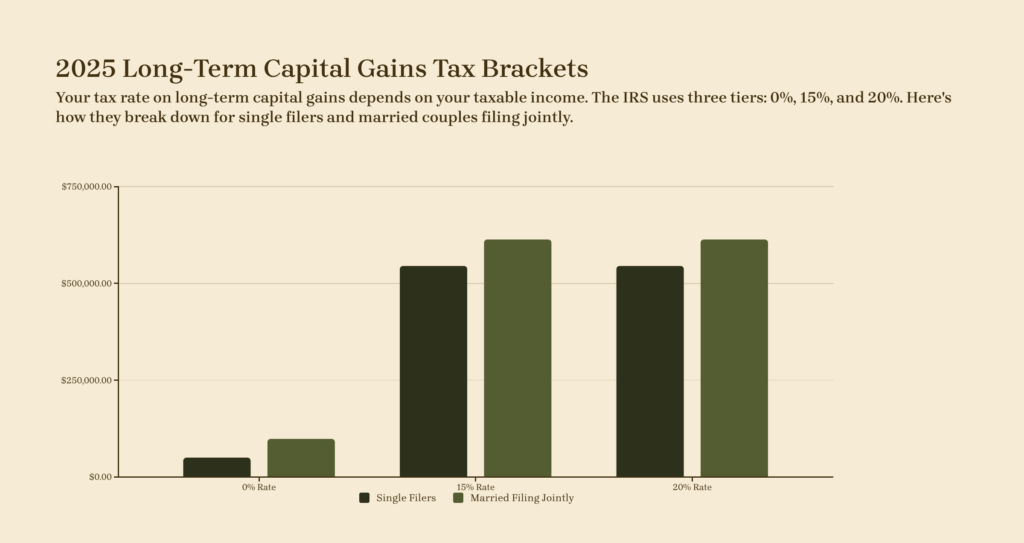

Long-Term Capital Gains Rates (for Tax Year 2025)

- 0% rate if your taxable income is:

- $49,450 or less (single filers)

- $98,900 or less (married filing jointly)

- 15% rate if your taxable income is:

- $49,451 to $545,500 (single filers)

- $98,901 to $613,700 (married filing jointly)

- 20% rate if your taxable income exceeds:

- $545,500 (single filers)

- $613,700 (married filing jointly)

Example

Let’s say Priya sells some stocks she held for over a year, and the sale results in $10,000 in capital gains. Priya is single, and her total taxable income (after the standard deduction) is $70,000.

- The first part of her $10,000 gain falls under the 0% capital gains tax bracket.

- The remaining portion is taxed at 15%.

In this example, Priya gets a huge benefit because the 0% capital gains rate applies to the first portion of her gain. If she had sold the stocks before holding them for a year, the gain would have been taxed at her regular income tax rate, which is higher.

Why It Matters for You

Capital gains taxes are an important part of your overall tax picture, especially if you have investments. Under the 2025 tax rules, it is often more beneficial to hold onto your investments for longer than a year to take advantage of the lower tax rates.

If you’re planning to sell investments in the near future, consider whether holding them for an additional year might make sense to qualify for long-term capital gains treatment.

Pro tip

If you are close to the $49,450 threshold for single filers or $98,900 for married filers, consider selling investments strategically to stay within the lower capital gains tax rate. You might save money by timing your sales and planning the amounts sold.

Conclusion: Taking Control of Your 2025 Tax Filing

By understanding the 2025 tax rules early, you can reduce stress and avoid mistakes when you file your return in 2026. Knowing how the standard deduction works, understanding tax brackets, and planning for capital gains gives you the tools to keep your filing process smooth.

If you’re unsure how these rules apply to your situation, especially if you have foreign income, assets, or a complex visa status, it’s always a good idea to seek expert guidance. Tax consultants can help ensure you’re not missing deductions or making costly mistakes.

If you still have questions or need personalized advice, feel free to contact Crescent Tax Filing’s expert team. You can book a consultation directly by emailing wecare@crescenttaxfiling.com, and we’ll walk you through your best filing options.

Proactive planning is the best way to make sure you’re prepared for tax season and keep your financial goals on track.