Table of Contents

Millions of Indian professionals and students live or work in the United States. Navigating the US India tax treaty and the India USA double taxation treaty is vital for anyone who wants to avoid double taxation India USA and benefit fully from provisions in the US India DTAA (Double Taxation Avoidance Agreement). For many, getting help from an experienced tax professional for Indians in the USA is the key to compliance and peace of mind as a visa holder, especially for those under the H-1B tax treaty India USA.

What Is the US India Tax Treaty?

The US India tax treaty is a legal agreement that prevents people from being taxed twice on the same income in both countries. It spells out rules for wages, investments, and other income categories, so Indian professionals and students can get real tax treaty India USA benefits. It is designed to protect your earnings as you navigate both U.S. and Indian tax laws.

Understanding Residency Rules Under the US India DTAA

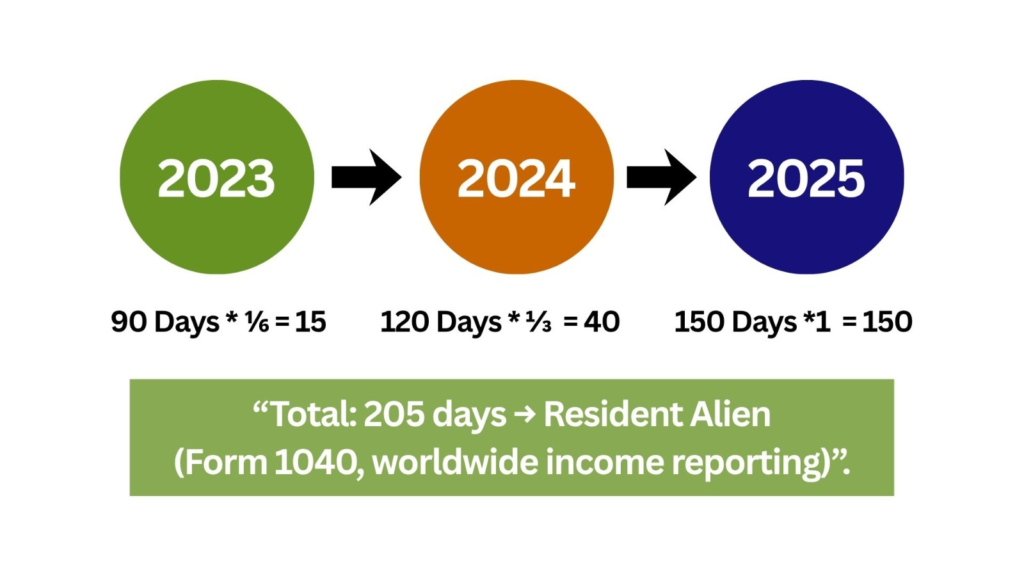

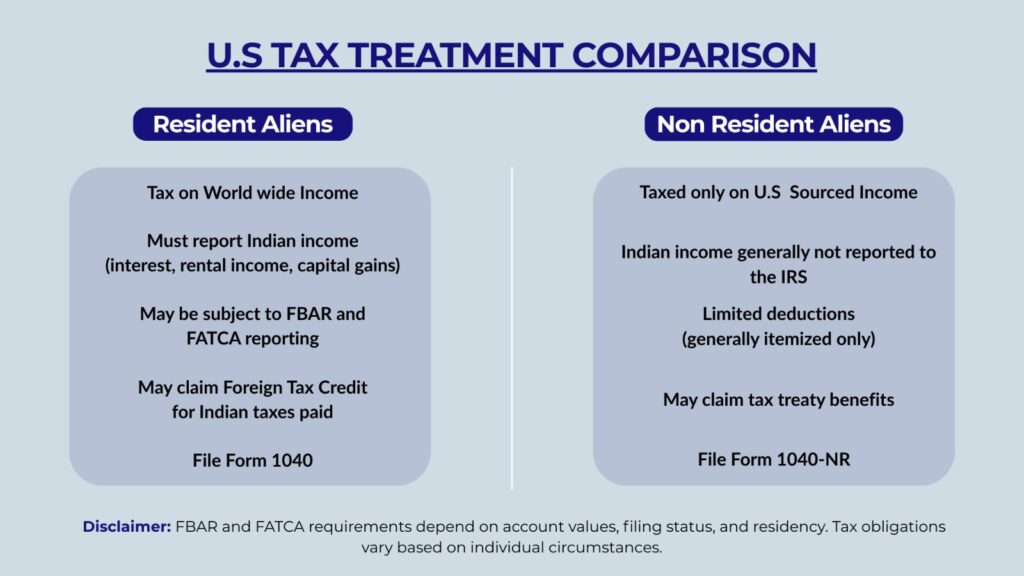

Determining your tax residency is crucial for applying the US India DTAA. The IRS uses a Substantial Presence Test . If you spend 183 days in the US (factoring in the current and previous two years using a weighted formula), you are a resident alien and need to report global income. The India USA double taxation treaty is the main safeguard here.

Some visa categories, like F-1 students and J-1 visitors, are exempt from this test for up to five years. However, most H-1B and L-1 visa holders quickly become resident aliens and must report their Indian and U.S. earnings.

Article 21: Unique Benefits for F-1 Students in the US India Tax Treaty

The treaty, particularly Article 21, grants Indian students specific benefits:

- Existence of exemptions for foreign-source scholarships and family support

- The opportunity to claim the U.S. standard deduction (e.g., $15,750 in 2025) — often unavailable to other nonresidents

- Benefits are time-limited, usually ending after five years, aligning with the treaty’s provisions.

Employment Income & the H-1B Tax Treaty India USA

In their initial years, H-1B and L-1 professionals file as nonresidents (Form 1040-NR). Once residency thresholds are crossed, they report worldwide income and may claim credits for Indian taxes paid via the tax treaty India USA benefits that prevent double taxation.

Claiming Foreign Tax Credits: Benefits Under the US India DTAA

One of the most valuable tax treaty India USA benefits is the ability to offset U.S. taxes with Indian taxes paid. You must file Form 1116 and keep detailed records like Indian tax payment receipts. This helps you avoid double taxation India USA, provided you don’t claim more credit than your U.S. tax liability.

Navigating F-1 to H-1B Visa Transitions

Many Indian professionals start on an F-1 visa, then shift to H-1B mid-year, creating complex situations. Maintaining records of the educational vs. work periods ensures you can claim the appropriate treaty benefits such as the Article 21 exemption and minimize risk of double taxation.

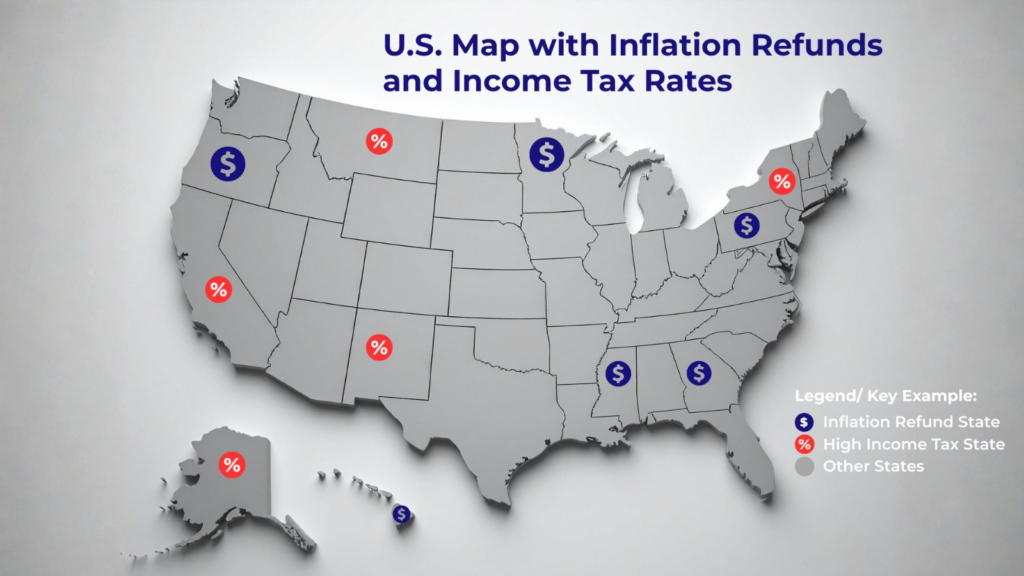

State Tax Considerations and Inflation Rebates

Most states recognize federal treaties, but some check whether rebates or inflation relief payments from the states impact your taxable income. Check your state’s rules to ensure proper treatment under the US India DTAA.

Foreign Account Reporting for Resident Aliens

Resident aliens with foreign accounts exceeding $10,000 must file an FBAR, and those with assets over specific thresholds (e.g., $50,000) in foreign assets must also file FATCA (Form 8938).

Non-Resident Aliens generally file Form 1040-NR to report U.S.-source income and are not subject to worldwide income reporting, though separate foreign reporting rules may apply in limited situations.

Failure to file required forms, when applicable, can result in significant penalties under U.S. tax law.

Claiming Treaty Benefits: Practical Steps

To use the US India tax treaty to its fullest, you should:

- File Form W-8BEN for nonemployee income

- File Form 8233 for treaty exemptions on employment income

- Submit Form 8843 if eligible

- Clearly disclose the treaty article and income type in your tax return.

Strategic Tax Planning Tips

- Maximize contributions to 401(k) and IRA accounts to reduce taxable income.

- Coordinate income recognition—by timing salary payments or sales—with your residency status.

- Allocate investments effectively, focusing on assets with maximum foreign tax credits.

- Careful planning of green card status impacts is essential since worldwide income becomes taxable upon achieving permanent residency.

Common Filing Pitfalls to Avoid

- Filling the wrong form (1040 vs. 1040-NR)

- Not claiming all treaty exemptions, especially Article 21

- Missing FBAR or FATCA deadlines

- Failing to keep supporting documents for treaty claims

FAQs About the US India Tax Treaty

- Does the US India tax treaty apply automatically?

No. You must file specific forms and claim the benefit directly. - Can resident aliens claim treaty benefits?

Yes, but mainly for tax credits. Most exemptions are for nonresidents. - Are H-1B and L-1 wages tax-exempt under the treaty?

No. You are generally taxed as a U.S. employee, but credits apply for Indian taxes. - Do I need to report Indian savings accounts and investments?

Yes, if you qualify as a resident alien and your assets exceed the FBAR or FATCA thresholds. - I’m on F-1 but working H-1B this year – what do I do?

You may have a year with mixed status; consult an expert to optimize filing and avoid double taxes.

Conclusion

The US India tax treaty and India USA double taxation treaty are powerful tools to avoid double taxation India USA and leverage tax treaty India USA benefits. Correct residency determination, timely filings, and active treaty claims maximize your savings and compliance. For tailored advice, work with specialists in cross-border taxation who understand both U.S. and Indian tax laws.

Disclaimer: Content published by Crescent Tax Filing is provided for general informational purposes only and does not constitute tax, legal, or financial advice. Tax laws and outcomes vary based on facts and circumstances. Use of this content does not create a client or advisory relationship. For personalized tax guidance, reach out to our professional support.