Table of Contents

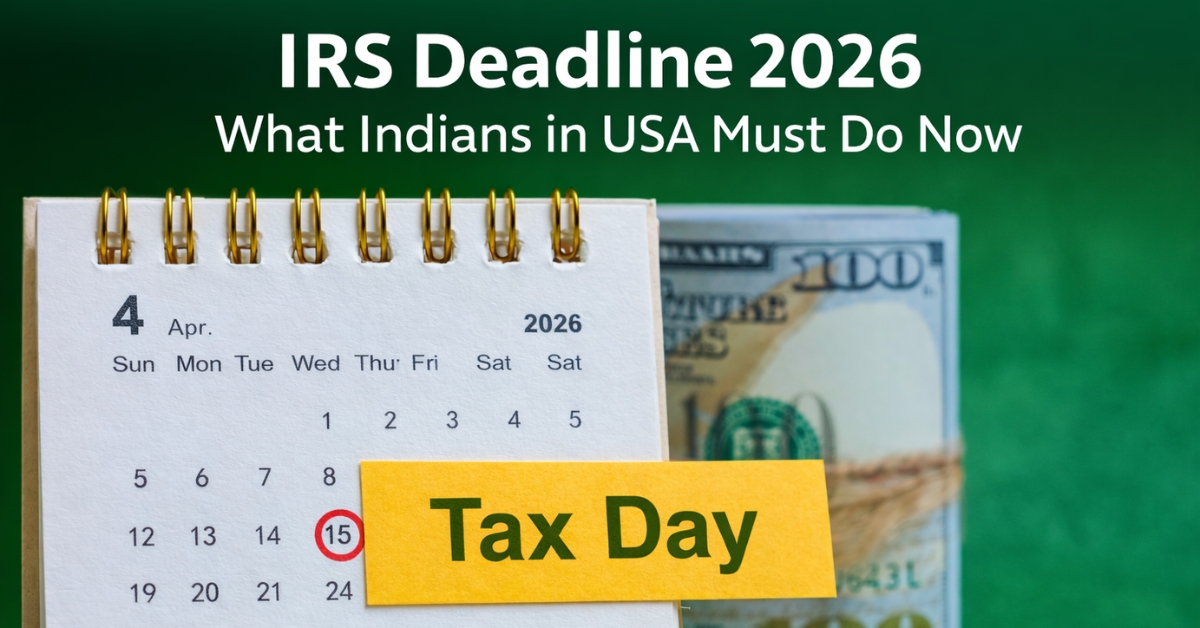

For many Indians in the USA, managing finances in two countries, India and the U.S., can be overwhelming. While understanding your income tax responsibilities is crucial, FBAR filing is a commonly overlooked requirement that can have serious financial consequences if missed.

FBAR, or Foreign Bank Account Report, is a report required by the U.S. government for U.S. taxpayers who hold financial accounts outside the country. If you fail to file your FBAR on time, the penalties can be severe. In this blog, we’ll explain what happens if you miss the FBAR filing deadline, the penalties involved, and how to file late without incurring the maximum charges. Additionally, we’ll discuss FATCA reporting requirements, professional tax services, and how you can stay compliant to avoid unnecessary fees.

If you’re worried about missing the deadline or need expert advice, Crescent Tax Filing offers a range of professional tax services to help you stay on track and avoid the stress of penalties.

Understanding FBAR Filing Requirements

The FBAR filing requirement applies to U.S. taxpayers, including both U.S. citizens and residents, who have a financial interest or signature authority over foreign financial accounts. This applies whether you are in the U.S. on a visa, permanent resident status, or even if you’re living abroad.

Who Needs to File FBAR?

If the total value of foreign financial accounts exceeds $10,000 at any point during the calendar year, you are required to file FBAR. This includes:

- Foreign bank accounts

- Foreign brokerage accounts

- Foreign mutual funds

- Foreign pension accounts

- Foreign accounts with a signature authority

It doesn’t matter whether the accounts generate income or if they are joint accounts with family members; if the balance exceeds $10,000, you must file FBAR.

For more detailed guidelines, you can refer to the official FBAR Filing Information page from the IRS.

What Is the Late FBAR Filing Penalty?

Missing the FBAR filing deadline can lead to significant penalties, and understanding the different types of penalties can help prevent future issues. The IRS imposes different penalties based on whether the failure to file is willful or non-willful.

FBAR Penalty Amount:

- Non-Willful Violations:

If you fail to file FBAR but the failure was not intentional, you will likely be subject to a penalty of up to $10,000 per violation. This applies for each year you fail to file, so if you missed the deadline for several years, the penalties can add up quickly. - Willful Violations:

If the IRS determines that the failure to file FBAR was willful, the penalty can be much higher. For willful violations, the penalty can be as high as $100,000 or 50% of the total balance of the foreign account, whichever is greater.

Example:

Ravi, a non-resident Indian on an H-1B visa in the U.S., had two accounts in India that each held more than $10,000. He was unaware of the FBAR filing requirement and missed filing for two years. The IRS imposed a non-willful penalty of $20,000 ($10,000 for each account).

Had he filed on time, the penalty would have been avoided.

You can read more about FBAR penalties on the Failure to File FBAR Penalty page.

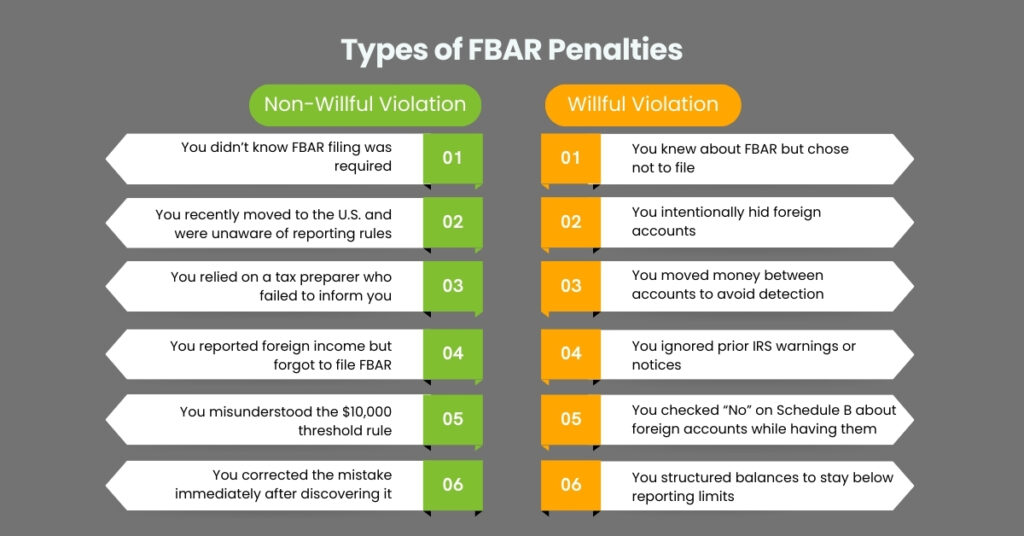

Types of FBAR Penalties

The FBAR penalty amount depends on whether the violation was willful or non-willful. Understanding this distinction is crucial to assessing your exposure to penalties.

Non-Willful Violation Penalty

If the failure was non-willful, the penalty is $10,000 per violation. This penalty applies for each year you failed to file the FBAR. In some cases, the penalty may be waived if the IRS determines that the violation was not intentional and the taxpayer acted in good faith.

Willful Violation Penalty

If the IRS deems your failure to file as willful, they may impose a penalty of $100,000 or 50% of the balance of the account, whichever is greater. This penalty is significantly higher, and the IRS often considers factors such as whether you intentionally hid the account from the government.

The IRS provides detailed guidelines for FBAR penalty amounts in the FBAR Penalty Guidelines.

How to File Late FBAR and Avoid Penalties

Even if you missed the FBAR filing deadline, you can still file late FBAR without facing extreme penalties by taking the right approach.

Voluntary Disclosure FBAR

If you missed filing FBAR for multiple years, you can still reduce your penalties through the Voluntary Disclosure Program. This program allows you to come forward and report your foreign accounts, which can significantly reduce the penalties for late filing, especially if you were unaware of the reporting requirements.

How to File FBAR Late:

- Download Form 114 (FBAR) from the IRS website.

- Complete the form with your personal details, including the names of foreign financial institutions.

- Submit it electronically through the BSA E-Filing System.

If you have foreign accounts that require FATCA reporting or FBAR filing, it’s best to consult with a tax expert to ensure you meet the filing requirements and avoid penalties.

For more about filing a late FBAR, refer to the IRS FBAR Filing Guide.

What to Do If You Miss the FBAR Deadline

If you missed the FBAR filing deadline, don’t panic. There are still steps you can take to minimize the consequences:

- File as soon as possible – The earlier you file, the less penalty you will face.

- Pay the penalties – Even if you missed the deadline, paying any penalties promptly will help reduce further consequences.

- Consult a tax expert – If you’re unsure about your filing status, tax consultants can help you navigate the complexities of FBAR filing and FATCA reporting.

Real-Life Case Study: FBAR Filing Mistake

Neha, a non-resident Indian working in the U.S., had three accounts in India. The total balance across all accounts exceeded $30,000, but she never filed FBAR because she thought she only needed to report U.S.-based accounts. When the IRS contacted her, she realized she had missed the filing requirement for multiple years.

After consulting with a tax expert, she was able to file the late FBAR and used the voluntary disclosure FBAR process to reduce the penalty. Though Neha was still penalized, the tax professional helped her minimize the damage by ensuring full compliance.

Frequently Asked Questions

1. What happens if I miss the FBAR filing deadline?

Missing the FBAR filing deadline can result in penalties. The late FBAR filing penalty may be as much as $10,000 per violation for non-willful violations, and up to $100,000 or 50% of the account balance for willful violations.

2. How do I file FBAR late?

You can file a late FBAR by completing Form 114 and submitting it electronically through the BSA E-Filing System. Consult with a tax expert to ensure full compliance.

3. What is the penalty for late FBAR filing?

The FBAR penalty amount varies depending on whether the violation is willful or non-willful. The penalty for a non-willful violation can be up to $10,000 per year, while willful violations may result in penalties of $100,000 or 50% of the account balance.

4. Can I avoid penalties for late FBAR filing?

Yes, filing a late FBAR as soon as possible reduces the penalty. Using the voluntary disclosure FBAR program may also reduce the penalties, especially for non-willful violations.

5. What are the FATCA reporting requirements for FBAR?

FATCA reporting requires U.S. tax residents to report their foreign financial assets if the total value exceeds certain thresholds. This includes accounts covered by FBAR and others like stocks, bonds, and insurance policies.

6. How can a tax consultant help with FBAR filing?

A tax consultant can guide you through the FBAR filing process, reduce penalties for late filings, and ensure compliance with FATCA reporting to avoid costly mistakes.

How Professional Tax Services Can Help

Missing the FBAR filing deadline or failing to meet FATCA reporting requirements can create major issues with the IRS. If you find yourself in this situation, tax experts can assist you in ensuring compliance and handling the complex rules surrounding international income and accounts.

Professional tax consultants are experienced in dealing with foreign account reporting, penalties, and the IRS. They can help you avoid costly mistakes, reduce penalties, and make the filing process smooth.

Conclusion

The FBAR filing deadline is critical, and missing it can lead to significant penalties and interest. If you fail to file FBAR on time, it’s important to take action immediately by filing the late FBAR and, if applicable, using the voluntary disclosure FBAR program to reduce penalties. Ignoring this process could lead to more severe consequences.

If you’re unsure about your situation or need help navigating the complexities of FATCA reporting or FBAR filing, it’s highly recommended to consult with a professional tax filing service USA. Our team of tax experts at Crescent Tax Filing is ready to assist you.

For personalized assistance, email advisors@crescenttaxfiling.com.

Disclaimer: This article is intended for informational purposes only and is based on publicly available IRS guidelines. It does not constitute legal or tax advice. For specific guidance related to your situation, please consult a licensed tax professional.