Table of Contents

For many Indians living in the U.S., US tax filing for NRIs feels confusing from the start. The rules are not unclear by themselves. The problem is that they are rarely explained in a way that fits an NRI’s real situation. Income in the U.S., savings in India, and sometimes property back home raise questions that most people struggle to answer correctly. If you want a clear starting point, you can refer to our detailed guide here.

Every year, the same doubts come up. Which tax return should I file? Does Indian income need to be reported? Am I compliant, or am I missing something important? Many search for an NRI US tax guide, yet still feel unsure. That uncertainty is what makes NRI tax filing in the USA stressful.

This blog explains how NRIs file U.S. tax returns in plain language. It focuses only on what matters and why it matters. The goal is clarity, not complexity.

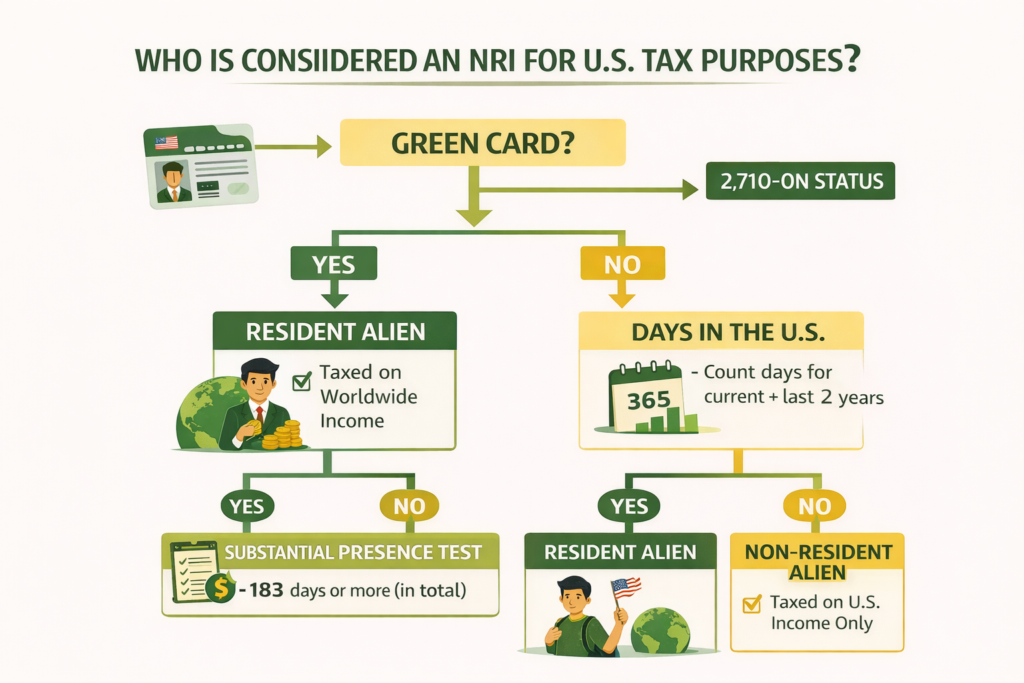

Who Is Considered an NRI for U.S. Tax Purposes

In the U.S. tax system, the word NRI is not used. The IRS does not follow Indian rules. It follows its own method of classifying people for tax purposes.

The IRS first decides whether you are treated as a U.S. tax resident for the year. This decision is based on two simple things.

One, whether you hold a Green Card.

Two, how many days have you stayed in the U.S. over time?

If you hold a Green Card, the IRS treats you as a tax resident.

If you do not, the IRS counts your days in the U.S. across the current year and the previous two years.

Based on this, the IRS places you into one of two groups.

These groups are referred to as Resident Aliens and Non-Resident Aliens.

This step is important because it decides:

- Which tax return do you file

- What income do you need to report

- Whether income from India is included

Most tax mistakes made by NRIs start here.

Resident Alien vs Non-Resident Alien

A Resident Alien is someone the IRS treats like a regular U.S. taxpayer for that year. This usually happens if you have a Green Card or if you have lived in the U.S. for enough days. The word “resident” here is only for tax purposes. It does not mean citizenship.

A Non-Resident Alien is someone whose link to the U.S. is smaller. This often includes students, new arrivals, or people who spend limited time in the U.S.

The key difference is how much income the IRS looks at.

- A Resident Alien must report income from anywhere in the world.

- A Non-Resident Alien usually reports income earned only in the U.S..

A real-life example

Ravi moved to the U.S. in 2021 for work. He now lives there full-time and works for a U.S. company. He also earns interest from a bank account in India. Because Ravi has lived in the U.S. long enough, the IRS treats him as a Resident Alien. He must report both his U.S. salary and his Indian bank interest on his U.S. tax return.

Ananya came to the U.S. in 2023 as a student on an F-1 visa. She works part-time on campus and earns a small salary in the U.S. She also has savings in India. Since Ananya has not lived in the U.S. long enough, the IRS treats her as a Non-Resident Alien. She usually reports only her U.S. income, not her Indian income.

Both Ravi and Ananya live in the U.S.

But their tax rules are different.

This is why understanding whether you are a Resident Alien or a Non-Resident Alien matters before filing any U.S. tax return.

| Category | Resident Alien | Non-Resident Alien |

| IRS basis | Green Card or Substantial Presence Test | Does not meet residency rules |

| Income taxed | Worldwide income | U.S.-source income |

| Indian income | Reported | Usually not reported |

| Tax return | Form 1040 | Form 1040-NR |

Example. An Indian professional working in the U.S. for several years is often a Resident Alien. An Indian student in the early years of study is usually a Non-Resident Alien. Both live in the U.S., but their tax filings differ.

How NRIs File U.S. Tax Returns

Once residency is clear, filing becomes straightforward. The IRS expects you to file the correct return based on your status.

| Residency status | Tax return |

| Resident Alien | Form 1040 |

| Non-Resident Alien | Form 1040-NR |

Filing the wrong return is a common mistake in US tax filing for NRIs.

Here is how common income types are generally treated.

| Income type | Resident Alien | Non-Resident Alien |

| U.S. salary | Reported | Reported |

| U.S. bank interest | Reported | Reported |

| Indian bank interest | Reported | Usually not reported |

| Indian rental income | Reported | Usually not reported |

| Capital gains in India | Reported | Usually not reported |

The word “usually” matters. Exceptions exist, but this table covers most beginner situations.

Reporting Income Earned in India

If you are a Resident Alien, the IRS expects you to report worldwide income. This means income earned anywhere during the year.

The IRS explains this rule under Taxation of Resident Aliens.

| Indian income type | Resident Alien | Non-Resident Alien |

| Bank interest | Reported | Usually not reported |

| Rental income | Reported | Usually not reported |

| Capital gains | Reported | Usually not reported |

| Salary from India | Reported | Usually not reported |

Example. You work in the U.S. and receive interest from an Indian bank account. As a Resident Alien, that interest must be reported on your U.S. tax return, even if tax was already paid in India.

Reporting income does not always mean paying tax again. Relief is available through credits.

The IRS explains this under Foreign Tax Credit.

FBAR and FATCA Reporting

FBAR and FATCA are disclosure rules. They apply even when no tax is due.

FBAR

FBAR applies when the total value of all foreign financial accounts exceeds $10,000 at any point during the year.

The IRS guidance is under Report of Foreign Bank and Financial Accounts (FBAR).

FATCA Form 8938

FATCA requires reporting specified foreign financial assets when thresholds are met.

The IRS explains this under About Form 8938, Statement of Specified Foreign Financial Assets.

| Requirement | FBAR | FATCA Form 8938 |

| Filed with | FinCEN | IRS |

| Focus | Bank accounts | Financial assets |

| Threshold | $10,000 aggregate | Varies by filing status |

| Filed with tax return | No | Yes |

The IRS comparison is available at Comparison of Form 8938 and FBAR requirements.

How the U.S.–India Tax Treaty Applies

The U.S. and India have a tax treaty to reduce double taxation. It applies only when claimed correctly.

The IRS explains treaties under United States Income Tax Treaties.

| Income type | Treaty impact |

| Salary | May reduce double taxation |

| Interest | Possible reduced tax |

| Dividends | Possible reduced rates |

| Capital gains | Usually taxed by residence |

Treaty benefits are not automatic. Incorrect claims can lead to delays or notices.

Common Mistakes NRIs Make

Most errors come from assumptions, not intent.

| Mistake | Result |

| Filing a wrong return | Incorrect reporting |

| Skipping FBAR or FATCA | Penalties |

| Ignoring Indian income | Compliance issues |

| Misusing treaty benefits | Refund delays |

U.S. Tax Return Checklist for NRIs

| Item | Purpose |

| W-2 or 1099 | U.S. income |

| Passport and visa | Residency review |

| Prior returns | Consistency |

| Indian bank statements | Income and FBAR |

| Indian tax records | Credits |

| Investment documents | Capital gains |

Ask yourself:

- What is my residency status this year?

- Which return applies?

- Do I have foreign income or accounts?

When Professional Help Makes Sense

Situations involving foreign income, asset reporting, treaty claims, or residency changes require care. Errors here often surface years later.

Frequently Asked Questions

1. Do NRIs need to file U.S. tax returns if they live in the SA?

NRIs may need to file a U.S. tax return if they earn U.S.-source income or meet the IRS filing requirements for the year. Whether filing is required depends on their U.S. tax residency status, income type, and income level. Living outside the U.S. does not automatically remove the filing requirement.

2. What tax form should an NRI use for U.S. tax filing?

The tax form depends on IRS residency classification.

NRIs treated as Resident Aliens generally file Form 1040.

NRIs treated as Non-Resident Aliens generally file Form 1040-NR.

Using the correct form is critical for proper reporting.

3. Can NRIs file U.S. taxes online from outside the United States?

Yes. NRIs can file U.S. tax returns electronically from outside the United States, as long as they have the required documents and a valid taxpayer identification number such as an SSN or ITIN. Physical presence in the U.S. is not required to file.

4. Is it possible to get a tax refund in the USA as an NRI?

Yes. NRIs can receive a U.S. tax refund if excess tax was withheld during the year or if eligible credits apply. Refund eligibility depends on income, withholding, tax treaties, and the type of return filed.

5. What happens if an NRI does not file U.S. taxes on time?

If an NRI does not file on time when required, the IRS may charge late filing penalties, interest, or both. In some cases, refunds may be delayed or lost if returns are not filed within the allowed time. Continued non-filing can lead to compliance issues.

Conclusion and Call to Action

US tax filing for NRIs becomes manageable once residency, reporting rules, and disclosure requirements are understood clearly.

For a personalized review, contact us directly at taxsupport@crescenttaxfiling.com or +1 (916) 241-4499.

Disclaimer: Content published by Crescent Tax Filing is provided for general informational purposes only and does not constitute tax, legal, or financial advice. Tax laws and outcomes vary based on facts and circumstances. Use of this content does not create a client or advisory relationship.