Table of Contents

Tax season is stressful for everyone, and if you miss the IRS deadline, the anxiety only increases. The IRS has set clear deadlines for filing, and for Indians in USA, the most crucial one is April 15, 2026. Missing this deadline may lead to penalties, interest, and even more confusion.

So, what happens if you miss the tax filing deadline USA? How does it impact your finances, and is there any way to avoid hefty penalties?

In this guide, we’ll explain exactly what happens if you miss the April 15 tax deadline, what penalties to expect, and how to avoid them.

If you’re in a situation where you’ve missed the filing deadline or are worried about it, there are professional tax services that can help you stay compliant with the IRS rules and ensure that everything is handled correctly. Let’s dive in.

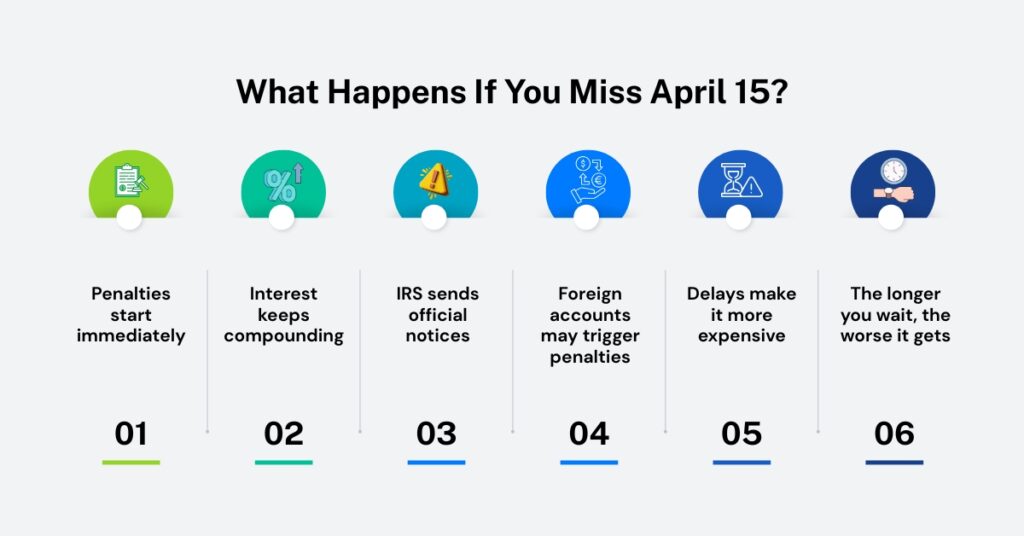

What Happens If You Miss the IRS Deadline April 15?

When you miss the April 15 deadline, several things can go wrong. The IRS late payment penalty, interest charges, and late filing penalties can quickly add up, depending on how long you delay your filing.

The IRS is strict about filing deadlines, and missing the April 15 date doesn’t just mean late paperwork; it also means potential financial consequences. So, let’s look at exactly what happens if you miss the deadline.

Late Filing Penalty

The late tax filing penalty is one of the most significant penalties the IRS can impose if you fail to file your tax return on time. This penalty is based on the amount of tax you owe and how late your filing is.

If you miss the deadline, the IRS starts charging a penalty at a rate of 5% per month of the tax you owe. This penalty can increase up to 25% of your unpaid tax.

Example:

If you owe $1,000 in taxes and file two months late, the penalty would be:

- 5% for the first month = $50

- 5% for the second month = $50

- Total penalty = $100

So, for every month you delay your filing, your penalty increases. Not only does this add to the financial burden, but it can also create additional headaches when trying to resolve it with the IRS.

IRS Late Payment Penalty

The IRS late payment penalty applies when you miss the payment deadline for your taxes, even if you’ve filed your tax return. The IRS charges this penalty at a rate of 0.5% per month for unpaid taxes.

Example:

Let’s say you owe $2,000 in taxes. If you don’t pay by April 15, you’ll be charged 0.5% per month on that $2,000. That means for each month you delay, you could face an additional $10 penalty on top of your owed taxes.

And, just like the late filing penalty, the late payment penalty can add up to a maximum of 25% of the total unpaid taxes. So, it’s important to pay your tax liability on time to avoid these penalties.

The IRS explains these penalties in more detail on its official page about the Failure to Pay Penalty.

Interest on Unpaid Taxes

Along with penalties, the IRS also charges interest on unpaid taxes. The interest rate is determined quarterly and is usually around 3% per year, compounded daily.

This means that even if you file your taxes on time but cannot pay the full amount, the IRS will begin to charge interest on the unpaid balance. This interest continues to accrue until the debt is paid in full.

Example:

If you owe $1,000 and miss the payment deadline, interest will start to accrue on that amount. After three months of interest, you could owe an additional $15 or more, depending on the IRS’s quarterly rate.

The IRS provides further details about interest rates on its official site.

Tax Extension After April 15

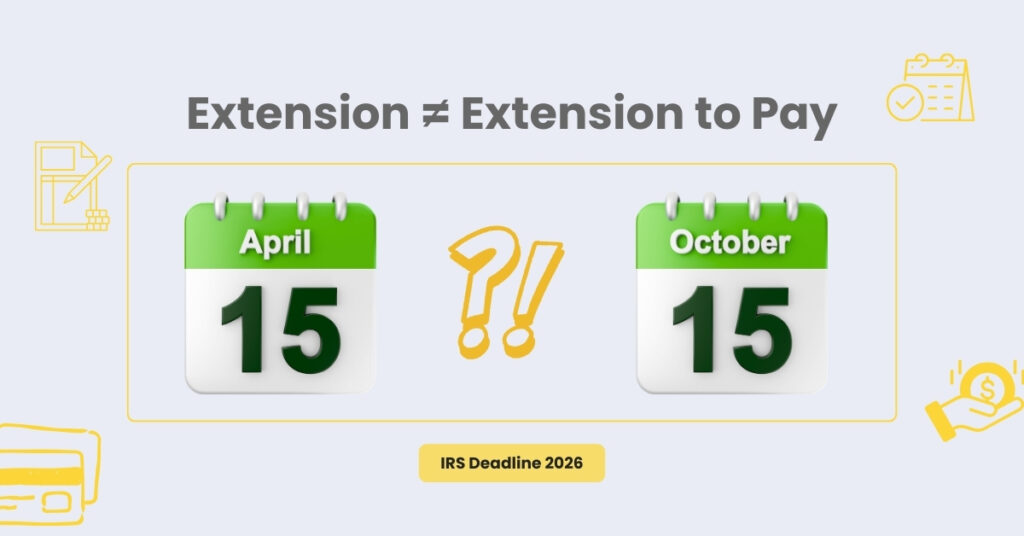

You might wonder, “Can I still get an extension after April 15?” Unfortunately, you cannot get a tax extension after April 15 unless you filed for an extension before the deadline.

However, if you filed for an extension on time (using Form 4868), you would have more time to file your return, until October 15, 2026. But here’s the crucial part: even if you file an extension, your tax payment is still due by April 15. If you owe taxes and fail to pay, interest and penalties will still apply.

How to avoid IRS penalties:

- File on time: The best way to avoid penalties is to file your taxes on time. If you can’t pay, file the return and pay what you can.

- Pay as much as possible: Even if you can’t pay the full tax due, paying a portion of your taxes by April 15 reduces the penalties and interest.

- File an extension early: If you need more time to prepare your return, file Form 4868 before April 15. This gives you an additional six months to file your taxes, but you must pay any taxes owed by April 15.

How to Avoid IRS Penalties

If you’ve missed the deadline or are about to, here’s how to avoid the worst penalties:

- File as soon as possible – The late tax filing penalty stops increasing once you file. So, don’t wait any longer to submit your return, even if you owe taxes.

- Pay what you can – If you owe taxes, make a payment, even if it’s partial. This helps reduce interest and penalties. The IRS will charge interest on the amount you haven’t paid.

- Request an extension – If you’re not ready to file by April 15, request a filing extension before the deadline. Remember, this only extends the filing date, not the payment date.

- Consult a tax expert – If you have complex tax filings (like foreign income tax, FATCA reporting, or FBAR filing), consulting with a tax expert can ensure you stay compliant and avoid costly mistakes.

The IRS will show more flexibility if you show that you’re trying to stay compliant. Just don’t ignore their deadlines.

Can You File Taxes Late Without Penalty?

In most cases, you cannot file taxes late without penalties. However, there are some exceptions:

- Disaster relief: If the IRS provides relief due to a natural disaster or other declared emergencies, you may get extra time without penalties.

- Mistakes due to IRS errors: If the IRS made an error in processing your return, it might waive penalties.

- First-time penalty abatement: The IRS may allow a first-time penalty abatement if you have a good record and missed the deadline by mistake.

But unless you qualify for an exception, you will likely face penalties and interest. To avoid penalties, file as early as possible and pay any taxes owed.

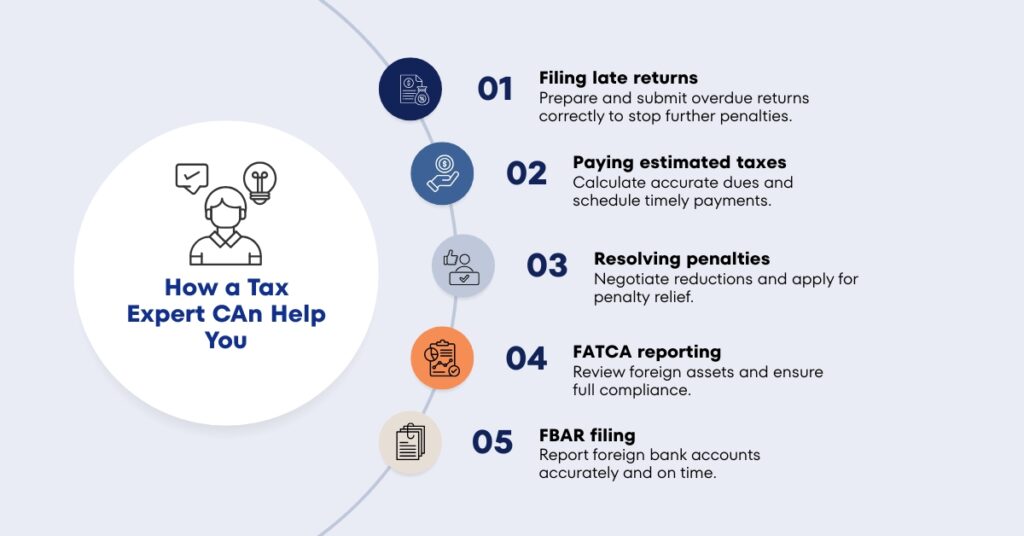

Professional Help to Handle Late Filing and Penalties

Dealing with late tax filing penalties, interest on unpaid taxes, or complicated filings like FBAR filing and FATCA reporting can be overwhelming. That’s where professional tax filing services come in.

A tax expert can guide you through:

- Filing late returns

- Paying estimated taxes

- Resolving penalties

- FATCA reporting

- FBAR filing

Having an expert handle your case reduces stress, minimizes penalties, and ensures you are in full compliance with IRS rules.

Frequently Asked Questions

1. What happens if you miss the IRS tax filing deadline 2026?

Missing the IRS tax filing deadline 2026 (April 15, 2026) can result in late tax filing penalties, interest on unpaid taxes, and possible issues with your visa or credit. Filing as soon as possible can reduce penalties and interest.

2. How can I avoid the late tax filing penalty?

To avoid the late tax filing penalty, make sure to file your taxes on time. If you cannot file by the deadline, request a tax extension using Form 4868 before April 15, 2026, and pay as much as you can to reduce interest charges.

3. What is the IRS late payment penalty, and how does it apply?

The IRS late payment penalty is a charge of 0.5% per month on unpaid taxes. It starts after the filing deadline and continues to accrue until the tax balance is fully paid. Paying even a partial amount helps reduce this penalty.

4. Can I file taxes late without penalty if I have no income?

Even if you have no income, you must file Form 8843 if you’re on an F-1 or J-1 visa. Missed tax deadlines USA can still result in penalties if you fail to file, even without owing any taxes. Filing on time helps establish your nonresident alien status for tax purposes.

5. What is the penalty for missing FATCA reporting or FBAR filing after the tax deadline?

Missing FATCA reporting or FBAR filing can lead to severe penalties. The IRS imposes $10,000 per violation for failure to file the FBAR and additional penalties for FATCA noncompliance. It’s crucial to report foreign bank accounts accurately and on time to avoid these costly penalties.

6. Can I get an IRS tax extension after April 15?

The IRS allows an extension of time to file through Form 4868, but it does not extend the payment deadline. If you miss the tax extension deadline USA, you still owe taxes by April 15 to avoid late payment penalties and interest.

Conclusion

Missing the IRS deadline April 15 is a serious issue, but the IRS allows options to minimize penalties and interest. Filing your return as soon as possible, paying what you can, and filing an extension are key steps to reducing consequences.

If you’re unsure or overwhelmed by the process, don’t hesitate to consult a tax expert to help you navigate through it all. The IRS is strict, but with the right preparation and professional guidance, you can keep penalties and stress at a minimum.

For a personalized review of your tax situation, email advisors@crescenttaxfiling.com. Our tax consultants are here to help.

Disclaimer: This blog is intended for informational purposes only and is based on IRS guidelines. It does not constitute legal or tax advice. For specific guidance related to your situation, please consult a licensed tax professional.