Table of Contents

For many Indians in USA, understanding U.S. taxes can feel overwhelming. Terms like resident alien and non resident alien often confuse people. However, these two terms have a huge impact on your tax filing. They decide which income you report, what deductions you are eligible for, and which tax return you should file.

Many Indians in the USA rely on tax consultants or search for tax filing services to help clarify these terms. But even then, there’s often confusion about non resident alien tax and resident alien tax rules, which is why having a reliable tax expert by your side is essential. Professional tax services can help simplify the process and ensure compliance.

This blog will explain the non resident alien meaning, how resident alien non resident alien classifications differ, and how to handle your taxes depending on which category you fall into. By the end of this guide, you will have a clear understanding of resident alien tax and non resident alien tax rules and how to file your taxes correctly.

How the IRS decides your tax status

The IRS does not decide your tax status based on your nationality. It looks at your presence in the U.S. and whether you meet specific conditions to be considered a resident alien or a non resident alien for tax purposes.

1. Green Card Test

The first step is simple. If you hold a Green Card, the IRS automatically classifies you as a resident alien for tax purposes. This means that, for tax filings, you are treated like a U.S. citizen.

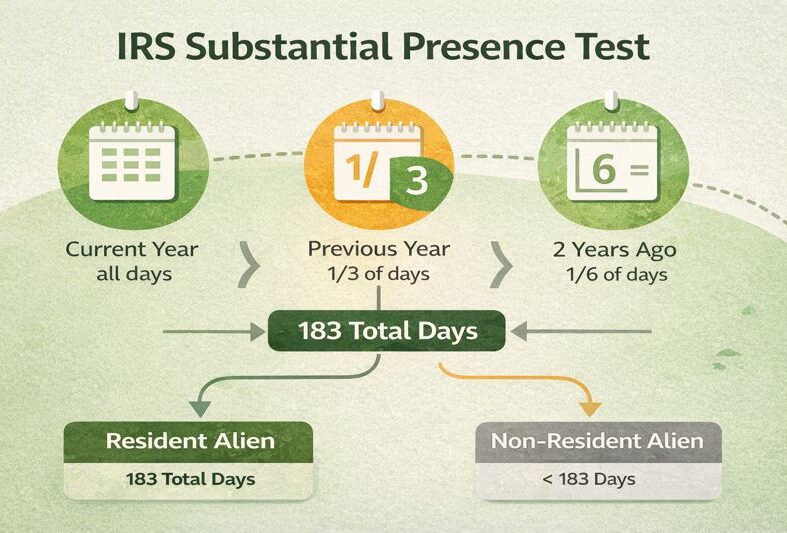

2. Substantial Presence Test

If you don’t have a Green Card, the IRS uses the Substantial Presence Test. This test is based on the number of days you have physically spent in the U.S. over a period of time, typically the current year and the previous two years.

For this test, the IRS counts:

- All days you spent in the current year

- One-third of the days from the previous year

- One-sixth of the days from two years ago

If the total number of days exceeds the threshold (183 days), the IRS will classify you as a resident alien for tax purposes. If it does not, you will be considered a non resident alien.

This process of classification is important because it determines:

- Which income you need to report

- Which tax forms you should file

- Whether or not you can claim certain deductions

|

IRS check |

Result |

|

Green Card holder |

Resident alien |

|

Meets day-count test |

Resident alien |

|

Meets neither |

Non resident alien |

The decision about whether you’re a resident alien or a non resident alien forms the basis for your entire tax return, so it’s crucial to get it right.

Non resident alien meaning and non resident alien tax

A non resident alien is someone who the IRS does not treat as a U.S. tax resident. This generally applies when you do not hold a Green Card and have not lived in the U.S. long enough to meet the Substantial Presence Test.

For a non resident alien, the IRS does not require you to report your worldwide income. You are only responsible for reporting U.S.-source income. This includes:

- Salary earned from a U.S. employer

- Income earned from services provided in the U.S.

- Certain U.S.-source interest and dividends

Income earned outside the U.S. is usually not included in your tax return as a non resident alien.

Which form does a non resident alien file

If you are a non resident alien, you will need to file Form 1040-NR, also known as the 1040 non resident tax return.

The IRS uses Form 1040-NR specifically for non resident aliens. This form has fewer deductions and different rules compared to the regular Form 1040 used by resident aliens. For example, you cannot take the same standard deduction, and your tax rates may differ.

Example

Rahul came to the U.S. for a short-term project in 2023. He worked for six months and returned to India. Since Rahul was not in the U.S. long enough, the IRS treats him as a non resident alien.

Rahul files Form 1040-NR and reports only his U.S. salary from the six months he worked in the U.S. He does not report income earned in India.

This is a common situation for Indians in the USA who work on short-term assignments or hold non resident alien tax status. Many people handling 1040 non resident filings for the first time seek guidance from a tax expert to avoid mistakes. Reliable tax filing services are available for support.

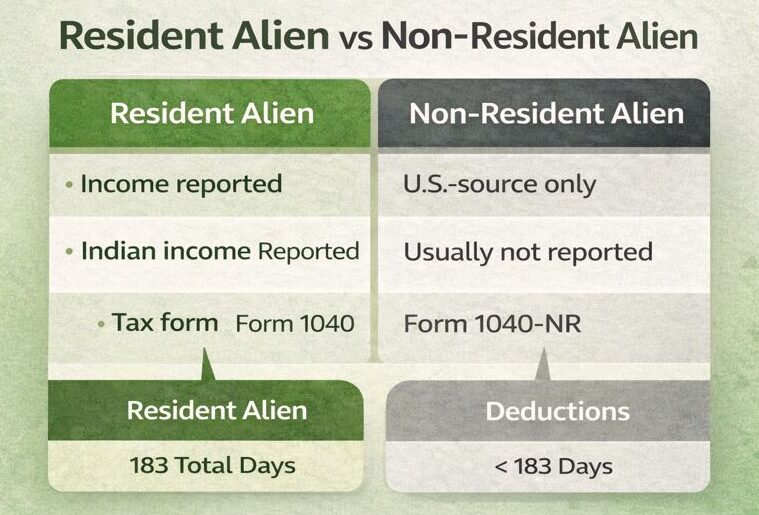

Resident alien tax and how it is different

Once you qualify as a resident alien, your tax obligations change. You must report your worldwide income, including income earned in India.

Unlike non resident alien tax rules, where you only report U.S.-source income, resident aliens report all income, whether it is earned in the U.S., India, or anywhere else in the world.

The IRS clearly explains resident alien tax rules under Taxation of Resident Aliens.

|

Category |

Resident alien |

Non resident alien |

|

Income reported |

Worldwide |

U.S.-source only |

|

Indian income |

Reported |

Usually not reported |

|

Tax form |

Form 1040 |

1040 non resident |

| Deductions | More options |

Limited |

Example

Suresh moved to the U.S. in 2021. He now works for a U.S. company and receives salary. He also earns interest from his bank account in India. Since Suresh has lived in the U.S. long enough to qualify as a resident alien, the IRS treats him as such.

Suresh files Form 1040 and reports both his U.S. salary and his Indian bank interest. He may be able to claim a foreign tax credit for the tax he paid in India, but he still needs to report all his global income first.

This shift from non resident alien tax to resident alien tax is common. Many Indians in USA may need assistance with the transition, which is why tax consultants or the best tax filing service are often sought. Reliable support is available through tax consultants.

FBAR filing and FATCA reporting

In addition to your tax return, the IRS requires certain U.S. taxpayers to report foreign accounts and assets.

FBAR filing

FBAR filing (Foreign Bank Account Report) is required if the total value of all your foreign bank accounts exceeds $10,000 at any point during the year. This includes accounts held in India, or any other foreign bank account you control.

FATCA reporting

FATCA reporting uses Form 8938 and applies when the total value of certain foreign financial assets exceeds IRS limits, which vary by filing status.

|

Requirement |

FBAR filing | FATCA reporting |

|

Filed with |

FinCEN |

IRS |

|

Form used |

FinCEN 114 |

Form 8938 |

|

Threshold |

$10,000 total |

Varies by status |

| Filed with return | No | Yes |

Many Indians in USA are unaware of these rules and file incorrectly. This is why it is always a good idea to consult with a tax expert or use tax filing services to ensure that you comply with U.S. tax reporting requirements.

Common mistakes to avoid

|

Mistake |

Result |

| Filing wrong form |

Delays |

|

Ignoring foreign accounts |

Penalties |

|

Skipping disclosures |

Compliance issues |

| Assuming Indian tax ends U.S. reporting |

Errors |

Frequently asked questions

Do resident aliens pay tax on foreign income?

Yes. Resident aliens must report all worldwide income, including income earned outside the U.S.

Do non-resident aliens pay U.S. tax on foreign income?

No. Non resident aliens only report U.S.-source income and do not include foreign income in their U.S. tax return.

How do I know if I am a resident alien?

The IRS uses the Substantial Presence Test and Green Card status to determine residency.

Can a non resident alien file Form 1040?

No. A non-resident alien must file Form 1040-NR.

Can I get credit for taxes paid in India?

Yes. If you paid taxes in India, you may be eligible for a Foreign Tax Credit to avoid double taxation.

Final thoughts

Understanding resident alien non resident alien status is essential for accurate tax filing. Once you understand your classification, everything else becomes easier.

If you want help reviewing your status or filing correctly, speak to a tax expert who understands NRI situations. Reliable professional tax services are available at best tax filing service.

Disclaimer: Content published by Crescent Tax Filing is provided for general informational purposes only and does not constitute tax, legal, or financial advice. Tax laws and outcomes vary based on facts and circumstances. Use of this content does not create a client or advisory relationship.